Learn the best index funds to invest in

A documented & unrefuted evidence on an Index that had outperformed both S&P500 and Warren Buffett's Berkshire Hathaway returns 1996-2016

Or read the Proof & Detailed Analysis below

It's a bold statement but if you can suspend your disbelief for the next 10 min, I'll reveal the figures & analysis.

This exact data analysis led my clients to dramatically shift their investments, taking my advice - a few proofs below

If my private-banking-category clients listened to my advice to invest hundreds of thousands, do you think I am qualified to dispense investment advice to you? You be the judge

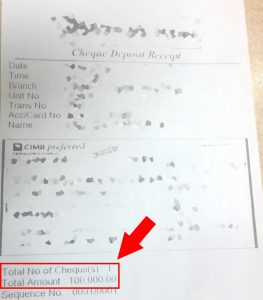

Proof#1 - 100k invested in one go

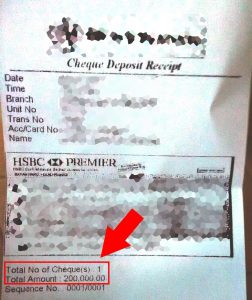

Proof#2- 200k invested in one go

Proof#3 - 100k invested in one go

"Why and how does this matter now me?" you asked Well, I think you'll agree with me when I say this:

When market is good, a blindfolded monkey can get returns easily.

But the real challenge comes when KLCI had been in the downtrend in 2014, 2015 & 2016.

The worse part?

RM depreciated to RM 4.5 vs USD.

The fears are real in today's market, can you relate?

The vicious cycle of fears, made many lose focus...

You may get distracted from your job/business and you...

...feel paranoia to read the business section in newspaper, deliberately avoid from listening or watching any economic news.

...lose sleep over it, wondering if you will have enough in the next 5 to 10 years to fund whatever financial goals you have

...skip a few heart beats every time any political or economic turbulence shave off 10% from your portfolio overnight before you even had the chance to login to your investment account

You don't need to from now on, here's why

The Proof & Analysis (Don't skip this section; read every word)

My findings cover the period from 1996 -2016 - exactly 20 years.

"Why 20 years?", you asked?

Answer: Because it is sufficiently long to see what kind of impact multiple major economic crisis had to a portfolio, yet not too long to unrealistically represent the behavior of the market in the 21st century.

Remember - before the 90's you didn't have unexpected things like Brexit or Trumponomics. Apart from that, investing information was not easily available at your fingertips via Internet - like today.

In the 90's, anyone who worked in investment industry had huge advantage and can easily gain extraordinary profit vs those who weren't.

Suffice to say - even Warren Buffett’s successes in the past (before the 90's) can’t realistically be repeated today as the dynamic has shifted permanently.

Now,

Buffett had famously beaten S&P500 by a large margin.

What if I prove to you there is something that beats his cumulative returns, for the last 20 years?

I am going to reveal to you that it's actually an Index.

Refer to the table below and...

Do the calculation yourself - here's how:

Step 1: Assume you start with 100,000 in 1996.

Step 2: S&P500 % return was 23% in 1996, so compute 100,000 x (1 + 23/100)

Step 3: You get 123,000. Next, compute 123,000 x (1 + 33.4/100) for Year 1997

Step 4: You get 164,082. Repeat the same step for 1998 until 2016. You will get the absolute value at the bottom of the column.

Step 5: Repeat Step 1 to 4 for the other two - namely Berkshire Hathaway % Return & X% Return

note: (S&P500 is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ).

You should get 756,211 vs 779,359

Now, since you can't invest directly into "Index X", there are a few ways you can track the performance of "Index X" so you can very well mirror similar annual returns - the X% return in the table above.

There are 2 ways to do this in Malaysia & Singapore.

But the truth is, you might not be the person to benefit from access to this information

If you are satisfied with mediocre returns and don't care about your future investment outcome...

...Or you don't have the burning desire to outperform Warren Buffett's portfolio, the S&P500 index or KLCI Index...

...Or you don't have the desire to be more successful than your peers

...Or you have a history of failing to take action when given opportunities...because you are too busy or [insert any excuses here]...

Then this is not for you

I can't make you care more about your investment or financial security...however, if you already have that in you, then register to attend the next webinar.